Mentis SONAR™

Mentis SONAR™

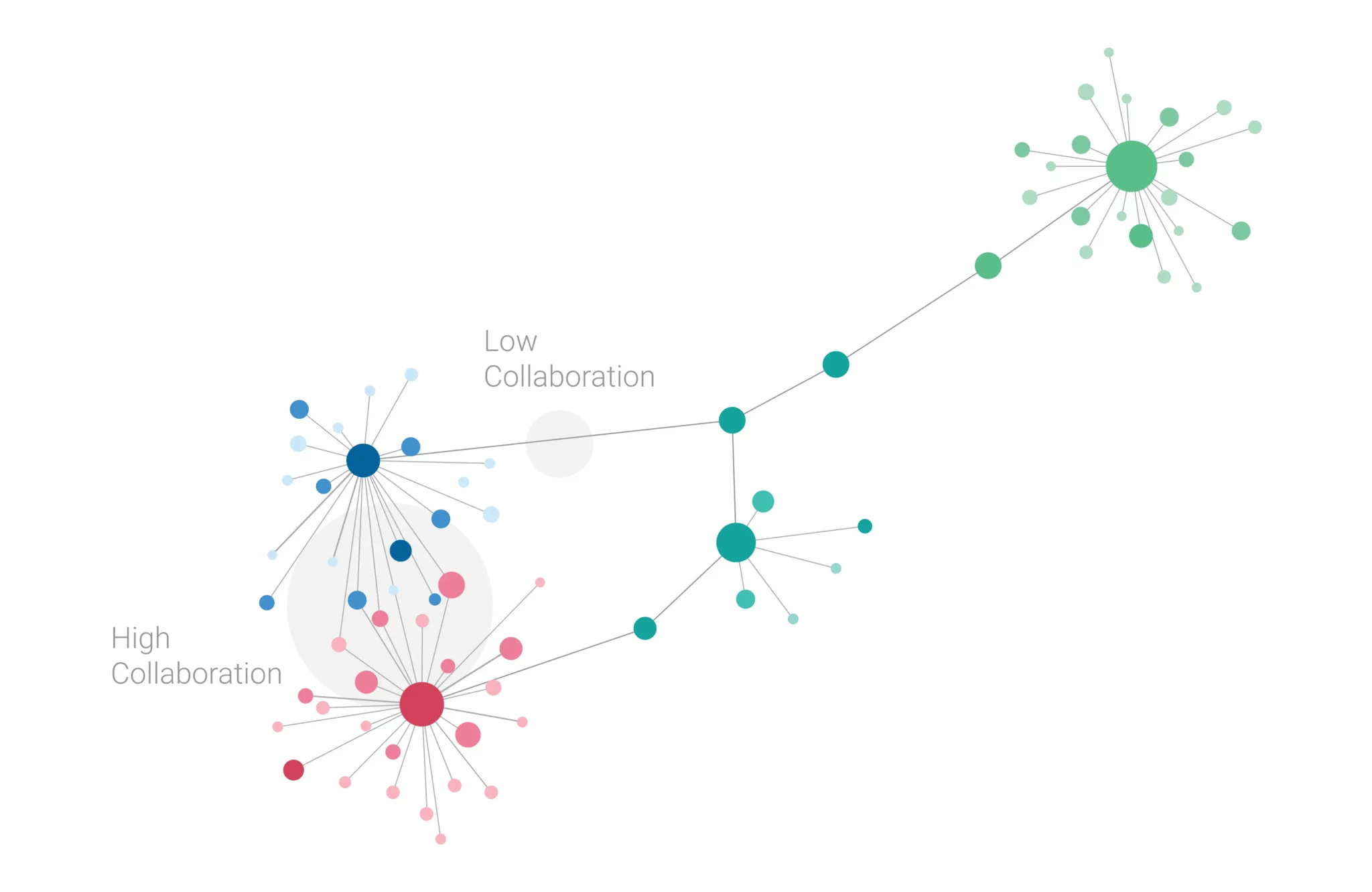

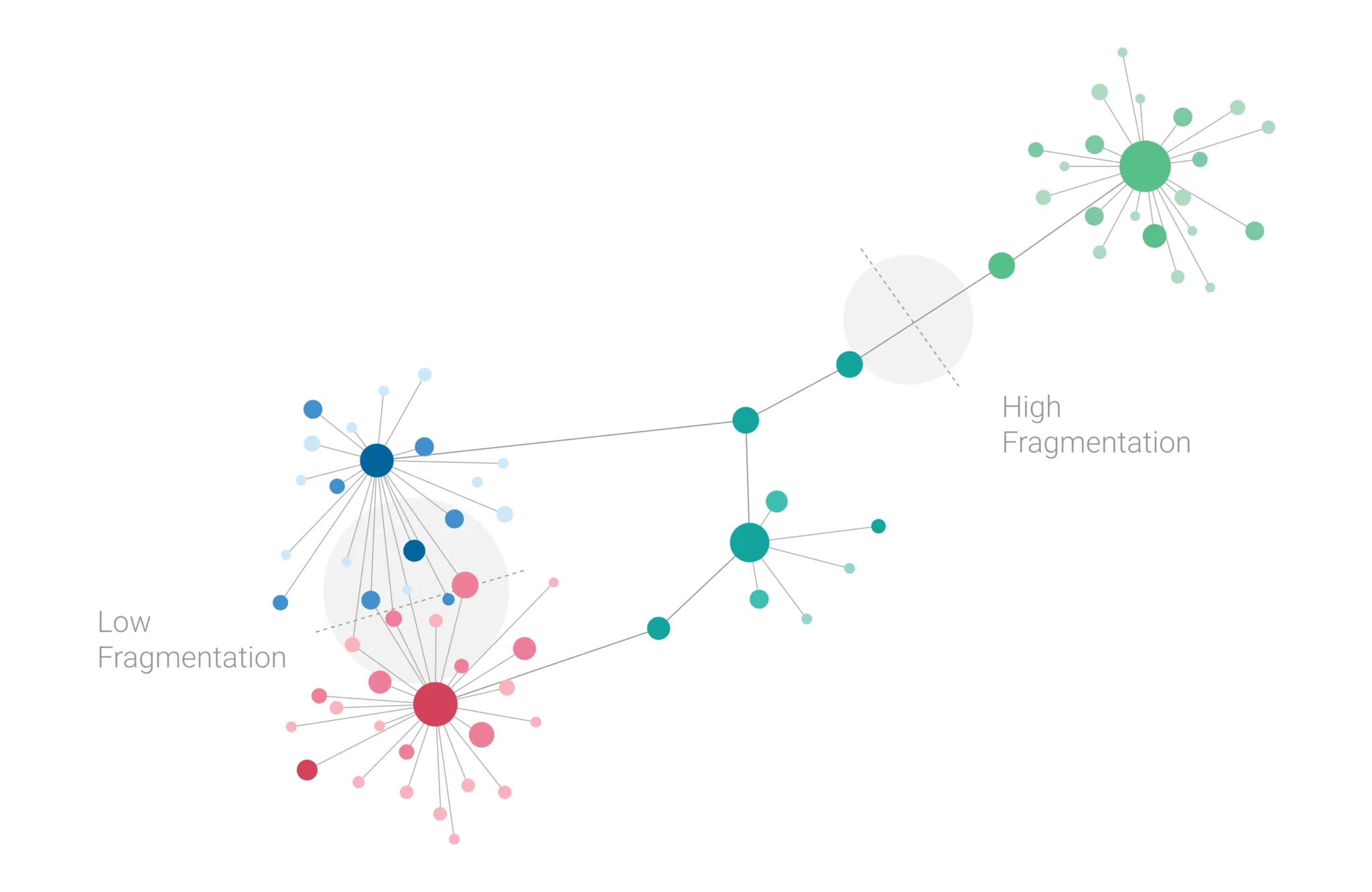

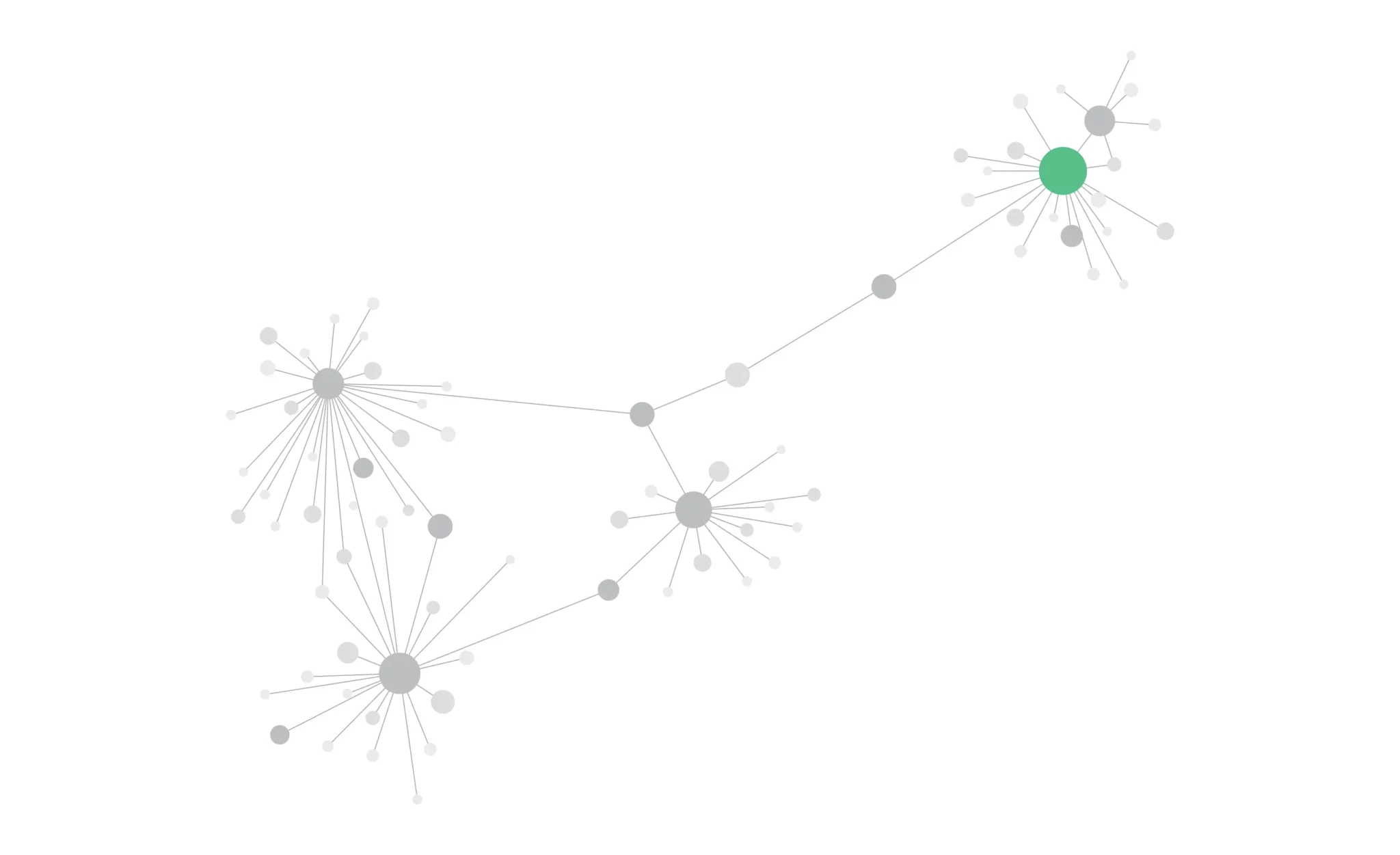

Network Centrality, Powerful People Networks

The value of identifying and nurturing the informal networks among colleagues.

All Meaningful Work Flows Through Networks of People and Resources.

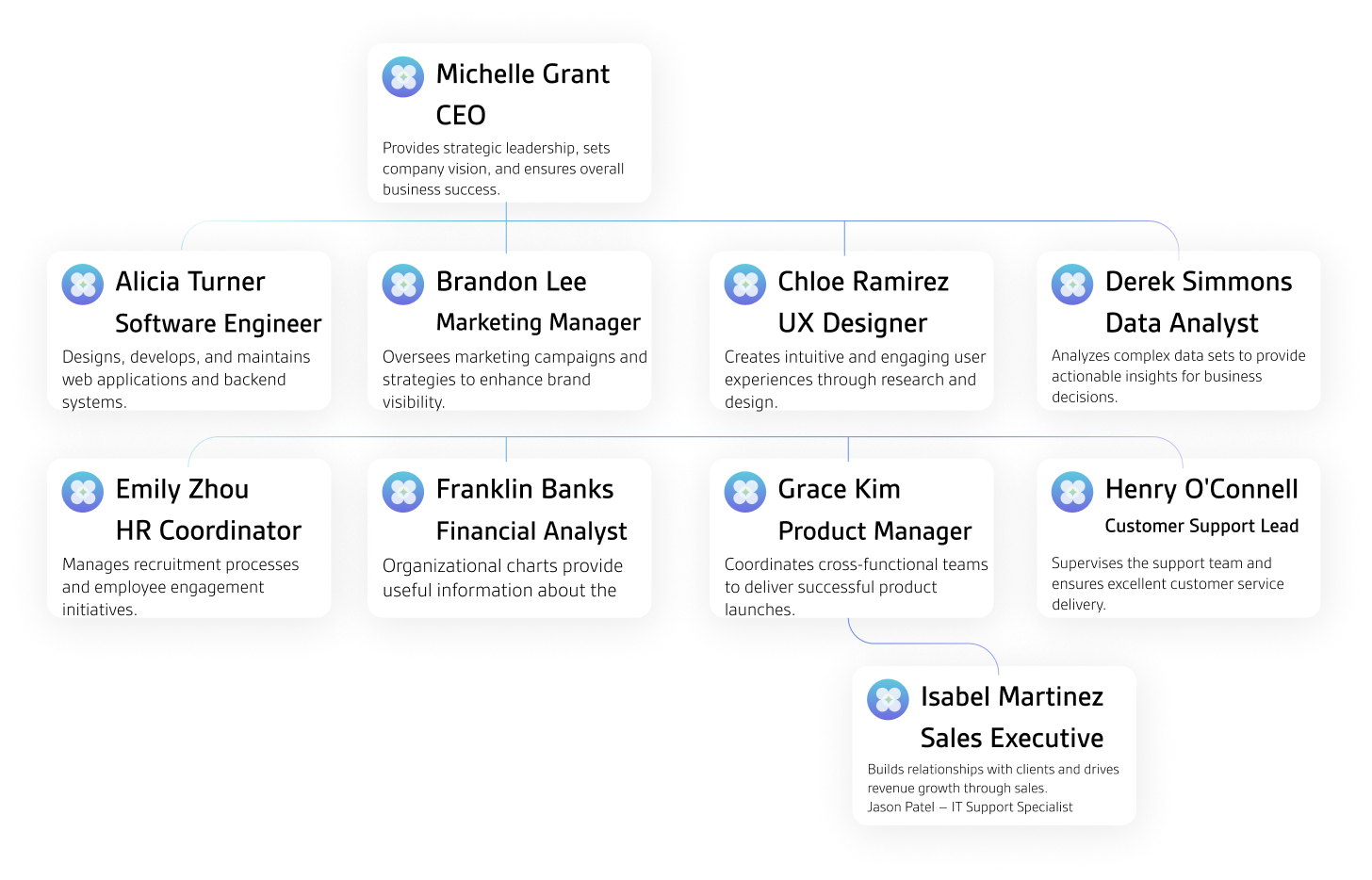

Traditional Hierarchy

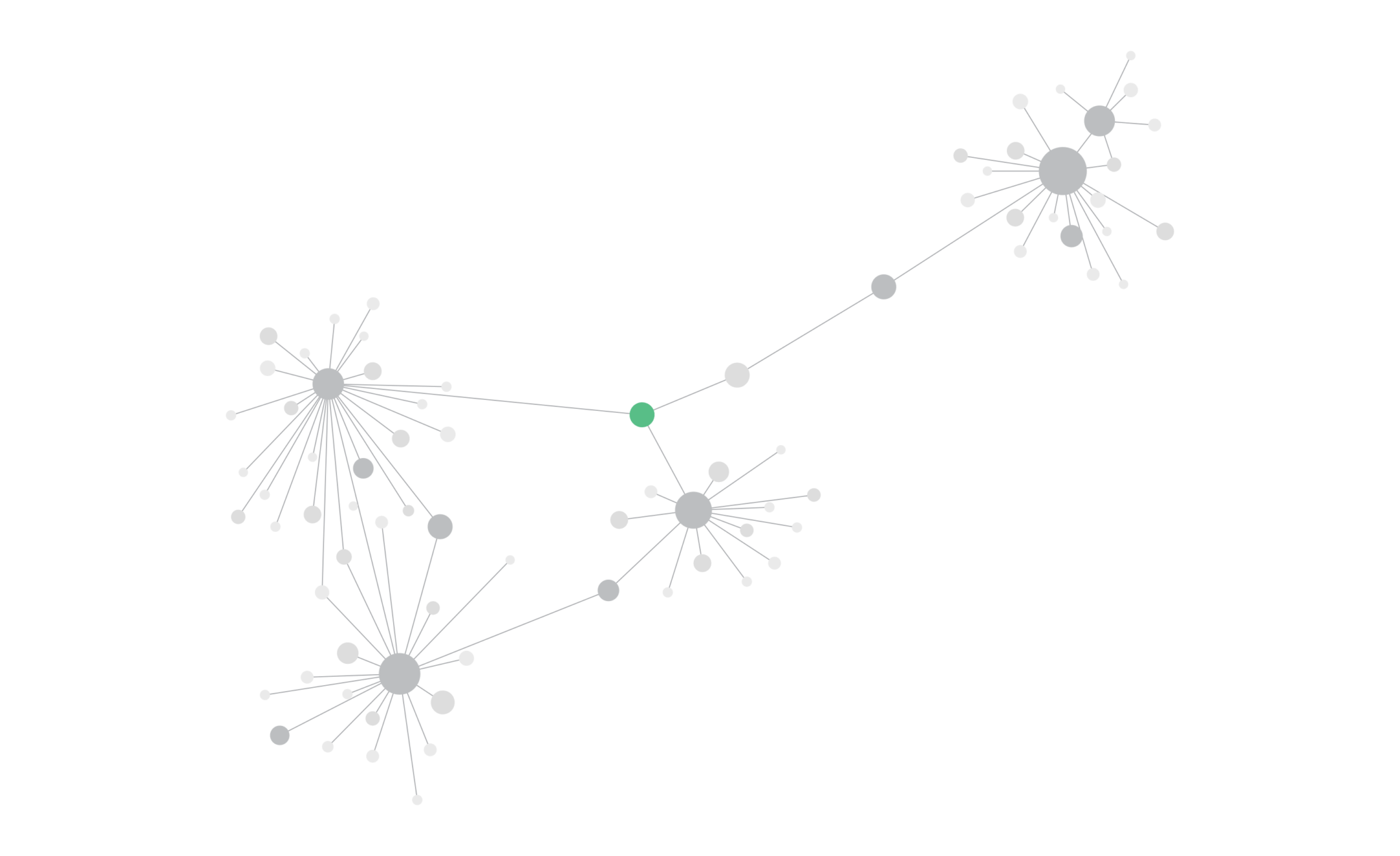

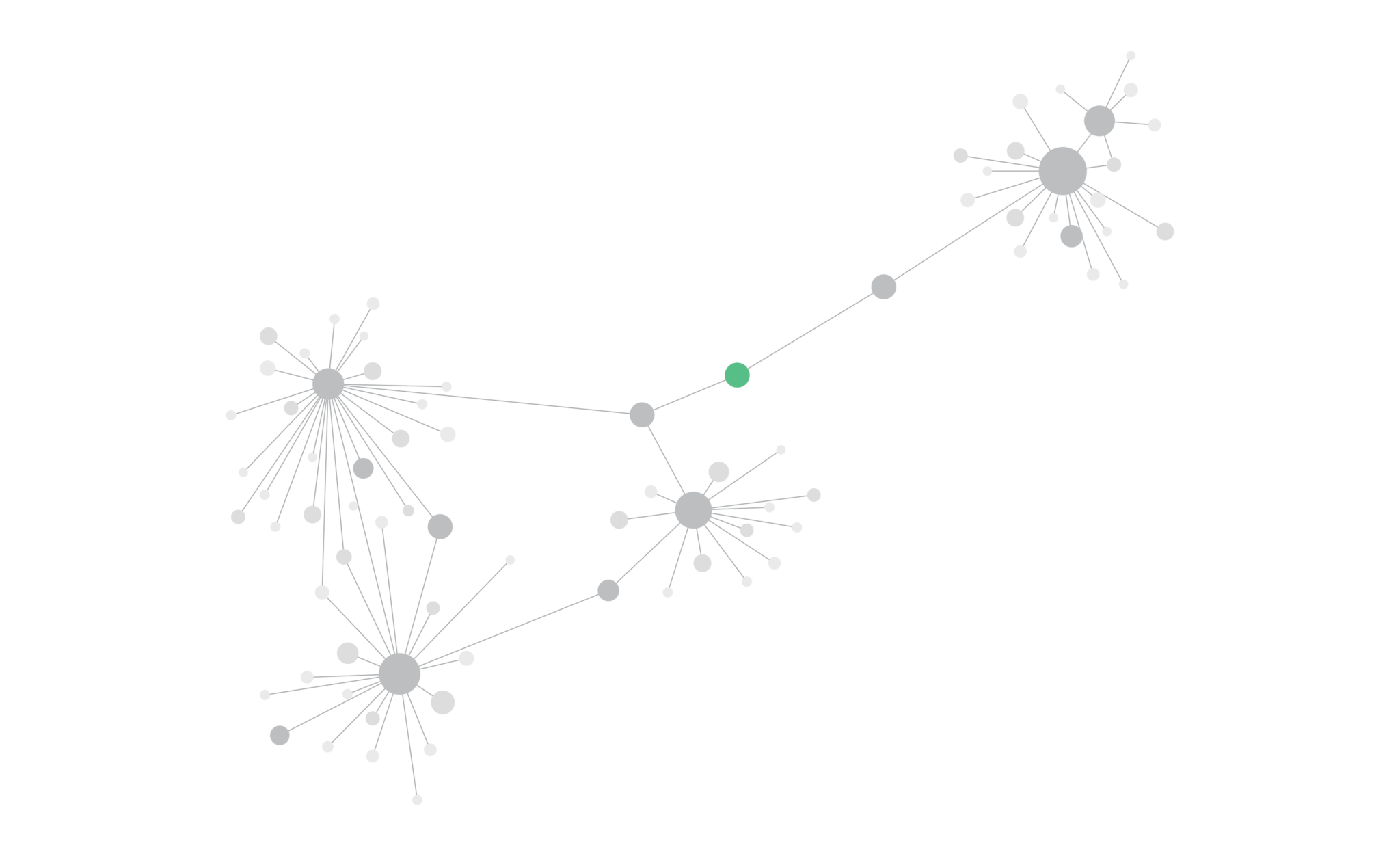

Real Dynamics of the Network

Traditional Hierarchy

Real Dynamics of the Network

Knowledge Sharing

and Learning

Colleague

Engagement

Innovation for the

Future

Diversity, Equity

& Inclusion (DEI)

Change

Management

Transforming Workflow

Efficiency

Case Studies

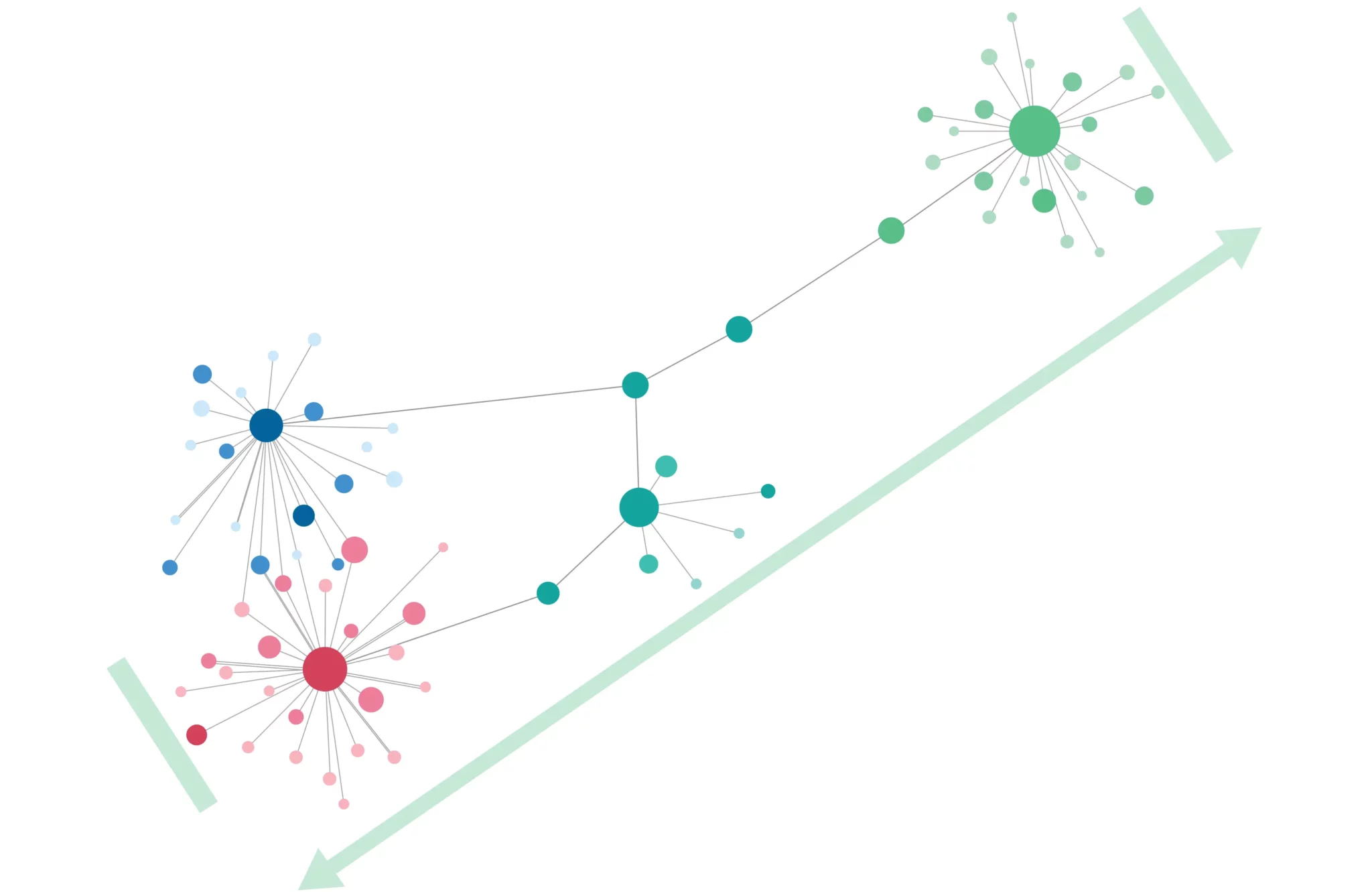

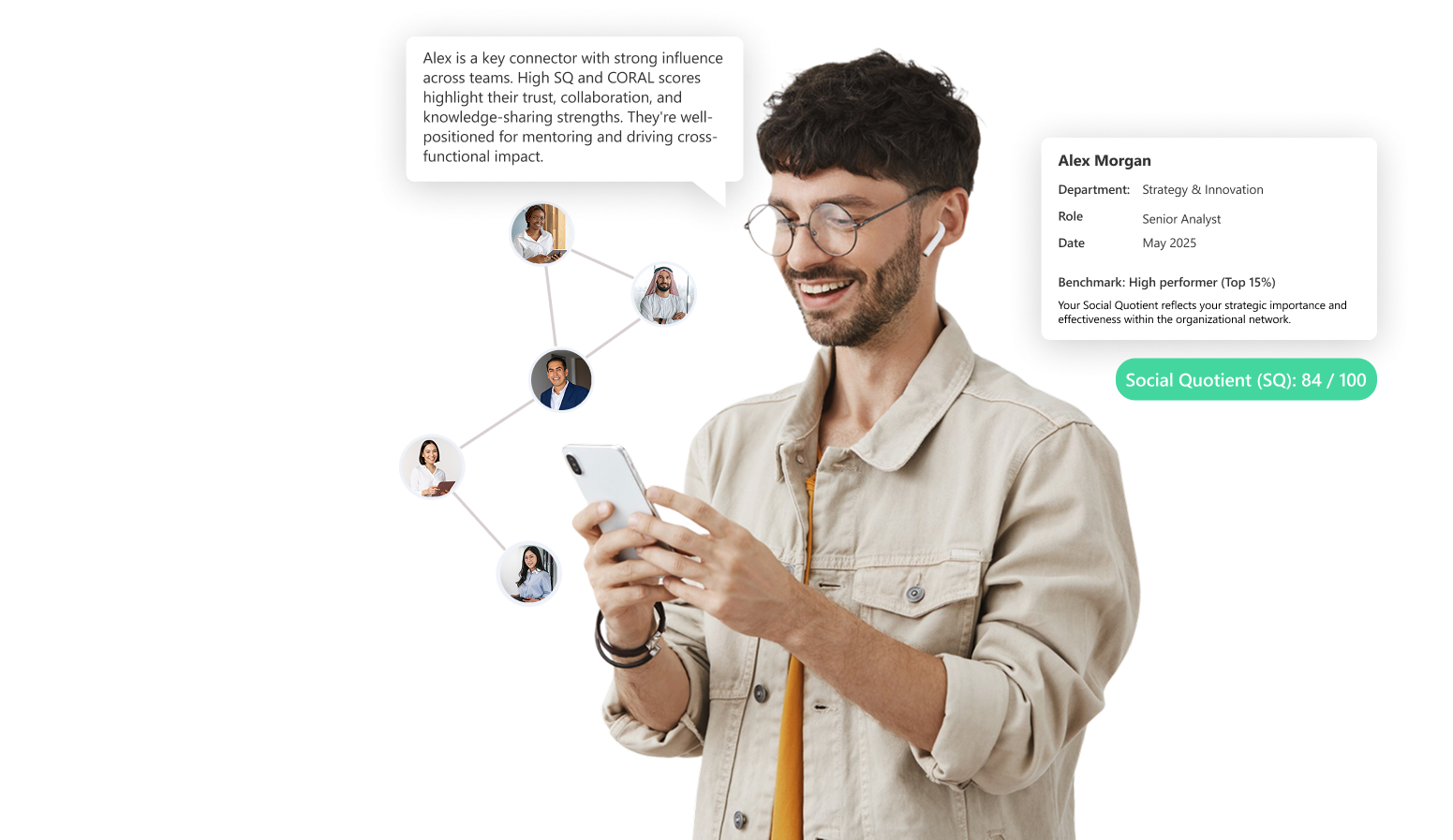

See Who’s Driving Impact in Your Network

Frequently Asked Questions

Is Network Centrality a test/assessment?

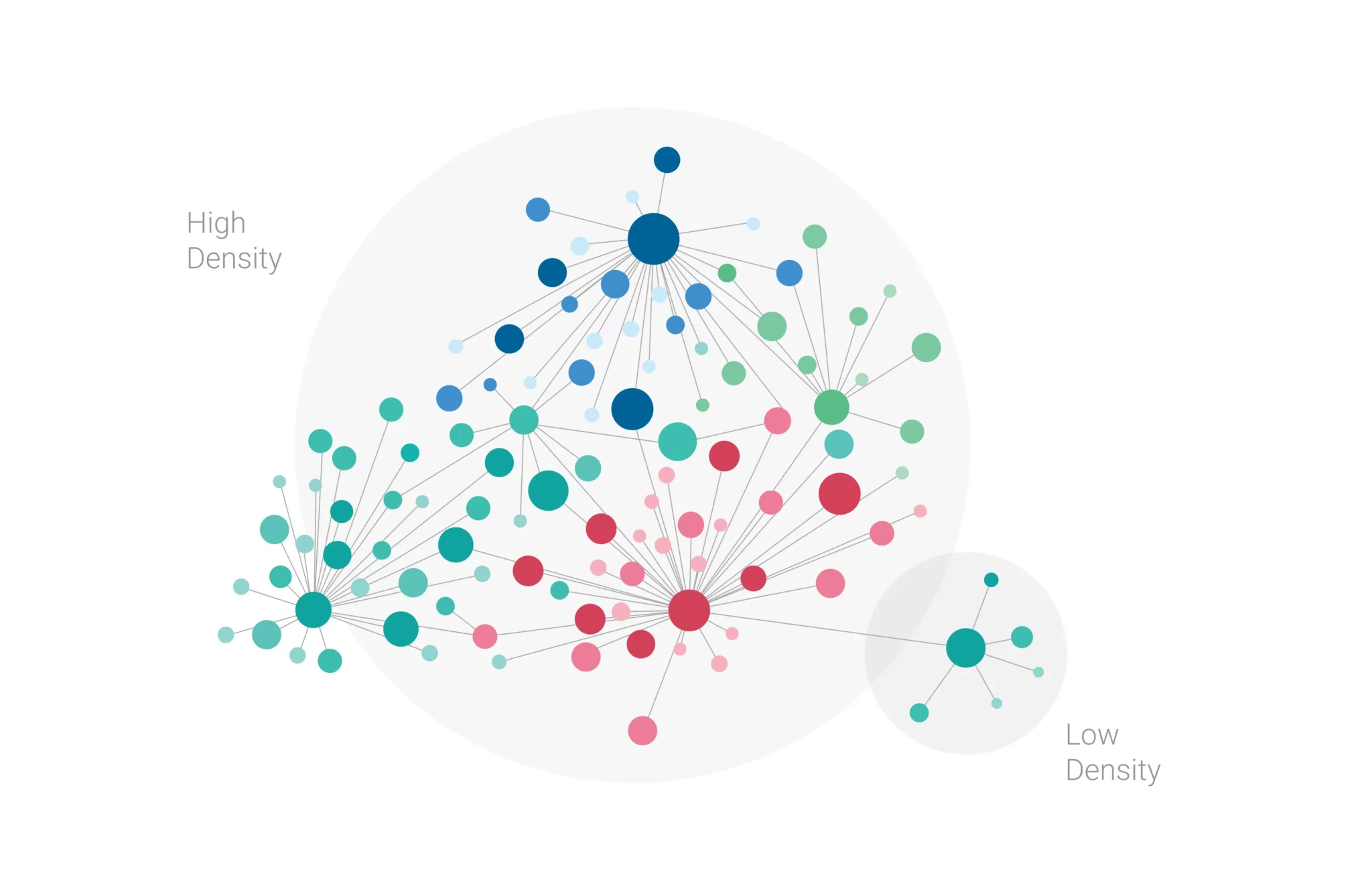

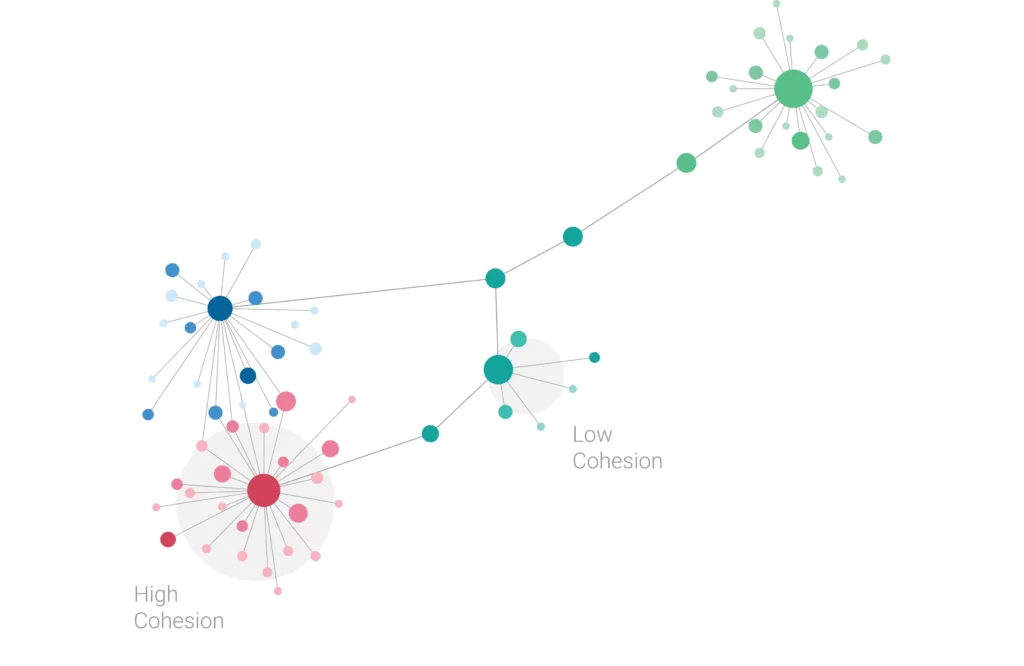

Network Centrality is a ‘sociometric’, meaning it is only concerned with measuring the relationships that exist between people. It is not an assessment or a test.

How do you weigh different criteria in process?

Data is collected through an active survey process and not through a passive data collection process (data mining). We believe that passive surveys are unethical. With us, participants of the network are invited to complete a brief survey comprising of 1- 3 question per network. Each question asks about relationships with co-workers in the context of the network being explored. This forms the basis of calculating Social Capital, Social Quotient and SONAR diagrams.

How does asking just 1-3 questions per network give the insight required?

With ONA, the accuracy of the outcome comes from the fact that its multiple people answering the same question to build up the true network, compared to psychometrics where its multiple questions to the same person.

The questions are directed to the entire network, allowing an accurate measure of the network to be determined based on responses from the actual network members.

The questions are directed to the entire network, allowing an accurate measure of the network to be determined based on responses from the actual network members.

How many networks should be covered in the survey?

While this does depend on the organisation’s needs, most organisations cover between 2-5 networks to provide sufficiently detailed data and actionable insights.

How long will the survey take participants?

This will depend on the number of networks covered in the survey and the size of the network, but typically the Network Centrality survey takes participants between 5 and 20 minutes to complete.

How many people should be included in the Network?

While there is no upper limit to the size of the network you can explore with Network Centrality, when there is less than 30 participants, we can’t guarantee all metric scores can be generated and a network with less than 20 participants is considered undesirable for adequate analysis and insight.

How long does data collection last?

Most Network Centrality projects capture the required data within 1-2 weeks. Very large networks may take longer given the number of participants involved. The time it takes is dependent on the response rate and speed of response by participants.

Should Network Centrality be repeated?

Yes is the simple answer, continuously tracking the strength of Social Capital within a network is one of the main insights of the tool. Given the nature of human relationships, networks are extremely dynamic and changeable over time and circumstance. Most Network Centrality projects repeat surveys every 3-6 months to identify how the networks are evolving within the organisation, and to determine efficacy of interventions and programmes. For larger networks (>200 pax) we recommend closer to 6 months between repeating to allow for the network to change during this time. For smaller networks (<75 pax), Network Centrality can be repeated at more regular intervals such as every 3 or 4 months since meaningful changes can occur quicker.